Bitcoin (BTC) adoption by U.S.-listed public companies continues to gain momentum.

The latest development comes from NYSE-listed Genius Group (GNS), which announced on January 10 that it has increased its bitcoin holdings to $35 million, surpassing its initial target of $120 million. The company acquired 372 BTC at an average price of $94,047 per bitcoin, marking a significant step in its “Bitcoin-first” strategy, first announced on November 12.

In addition to its bitcoin purchase, GNS also reported a rights offering on Tuesday, allowing shareholders to acquire additional shares at discounted rates. If fully subscribed, this offering could generate $33 million for the company. GNS founder and CEO Roger Hamilton expressed his commitment by participating in the offering to purchase 500,000 shares himself.

The company is exploring the option of loan financing to further bolster its bitcoin assets, a move that reflects a broader trend among publicly traded companies. Following these announcements, GNS shares closed 7% higher on Tuesday.

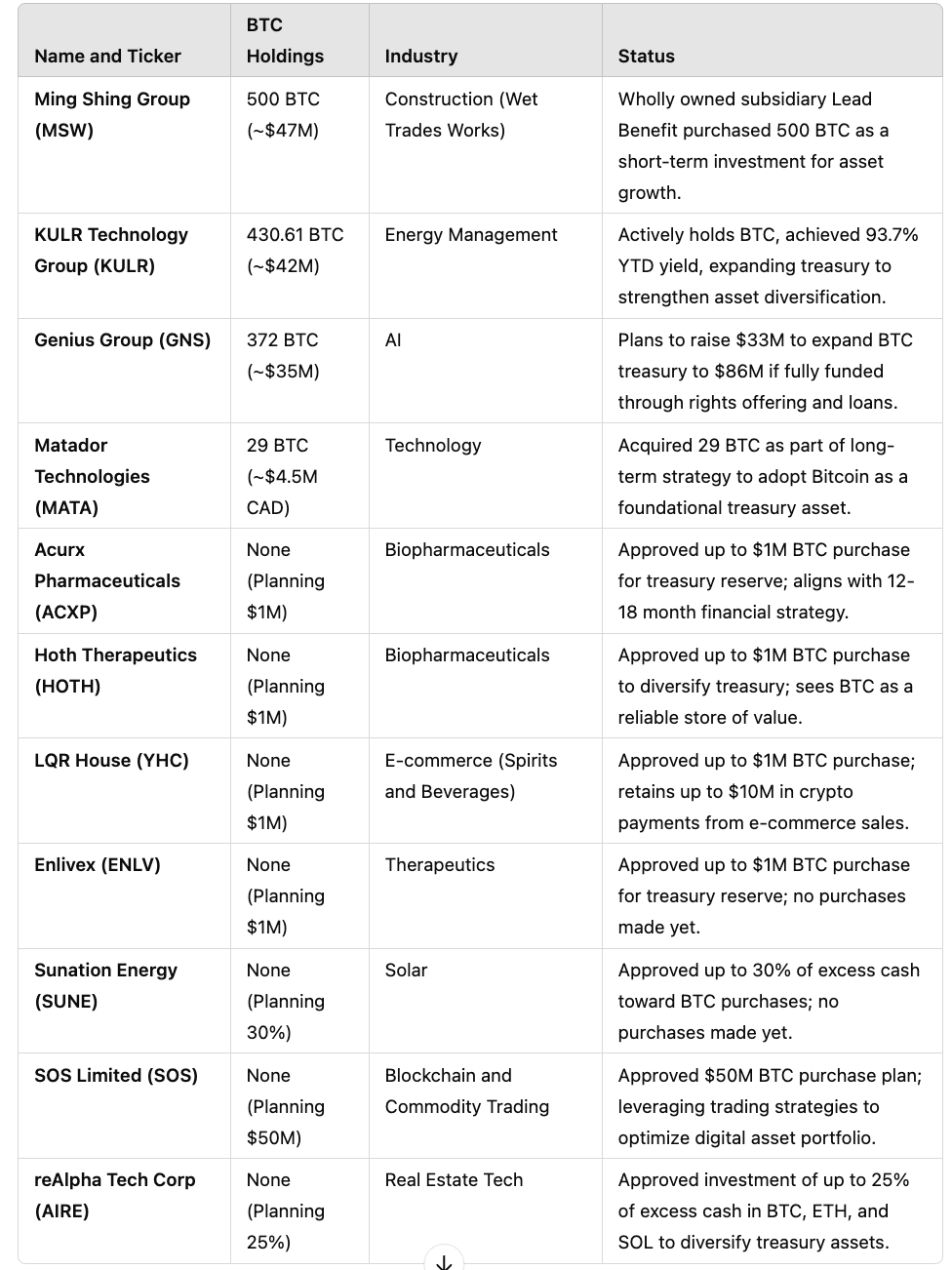

In a parallel development, Nasdaq-listed Ming Shing Group (MSW), a provider of wet trades works services, also recently acquired 500 BTC at an average price of $94,375. Impressively, MSW shares have risen by 43% year-to-date, reflecting increased investor confidence in the company’s strategy.

This burgeoning wave of bitcoin treasury adoption is characterized by four publicly traded companies announcing bitcoin purchases, with seven additional companies unveiling their strategies without yet making acquisitions. This trend indicates a growing recognition of Bitcoin as a viable asset class among traditional corporations.

As these companies continue to leverage Bitcoin’s potential, the landscape of corporate finance is evolving, with implications that could resonate across various sectors for years to come.