Bitcoin long-term holders have seen their spending accelerate recently, with the largest daily spike of the year recorded on Friday.

1 To 2 Years Old Bitcoin Investors Made Up For The Biggest Part Of The Spike

In a new post on X, on-chain analytics firm Glassnode has discussed the notable recent activity among Bitcoin long-term holders (LTHs). This group consists of Bitcoin investors who have held their assets for over 155 days.

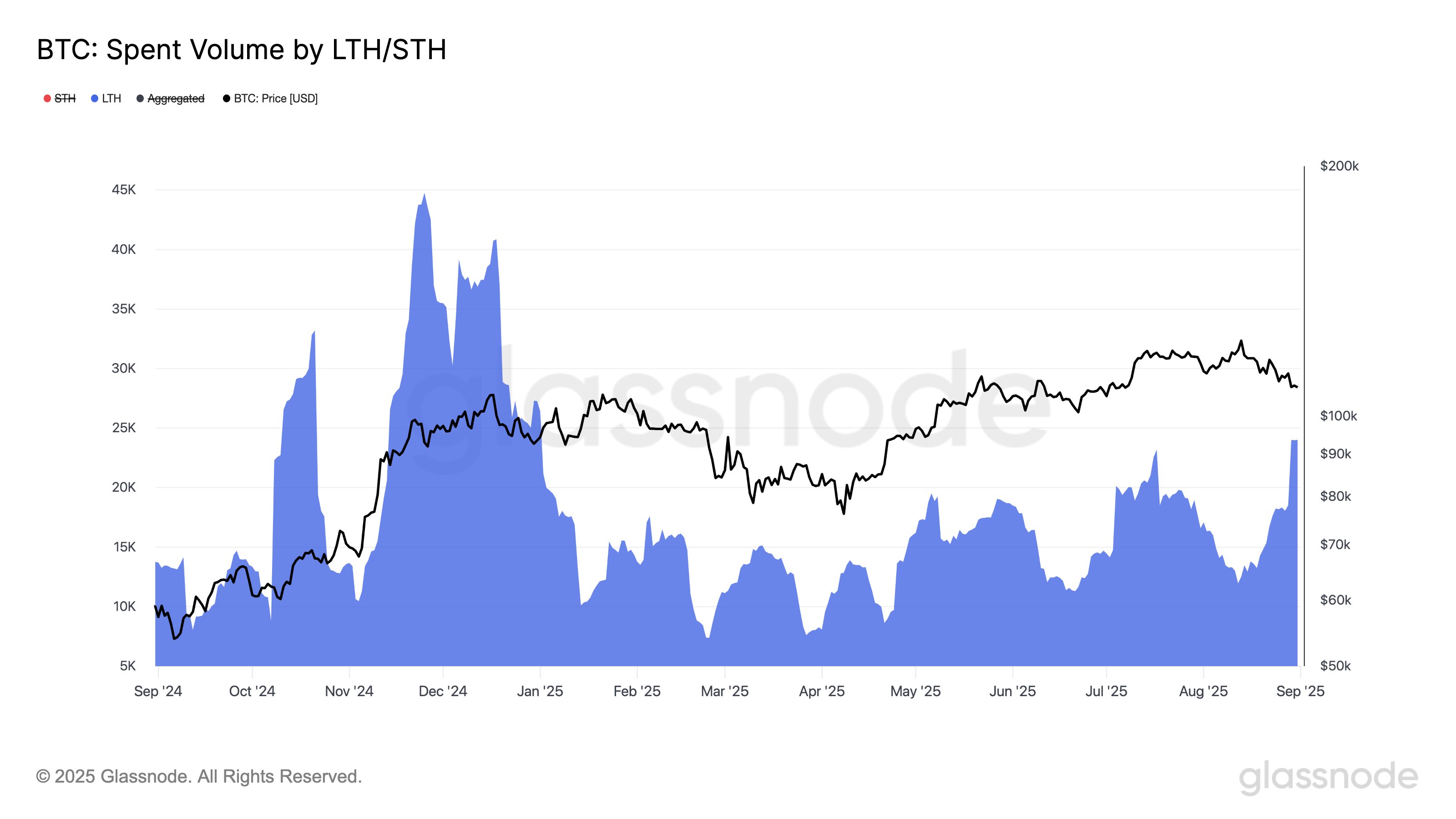

Statistically, prolonged holding correlates with a decreased likelihood of future sales, making LTHs a resilient segment of the market. However, even these steadfast holders occasionally decide to liquidate their investments. The following chart shared by Glassnode illustrates the fluctuations in spending by this cohort over the past year.

The graph indicates a recent surge in the 14-day simple moving average (SMA) of Bitcoin volume spent by LTHs, suggesting an uptick in transaction activity among those who typically hold onto their assets.

This spike in LTH spending coincided with a decline in Bitcoin’s price. This timing raises questions about whether some holders are anticipating the end of the current bull run and are choosing to secure their profits while possible.

While Bitcoin LTH transactions have spiked recently, it’s important to note that spending levels are still well below those observed in the last quarter of 2024. Moreover, the smoothed data of the 14-day SMA suggests this increase may be largely attributed to a single significant daily spike.

This notable spike on Friday saw approximately 97,000 BTC, valued at a staggering $10.6 billion, marking the largest spending day for LTHs in 2025 to date.

The LTH group’s 155-day cutoff encompasses a wide range of investors, and another chart highlights how various segments contributed to this spending spike:

Data reveals that the 1 to 2-year-old Bitcoin holders accounted for the largest portion of the spike, contributing 34,500 BTC. The segments holding for 6 to 12 months and 3 to 5 years each added around 16,000 BTC.

BTC Price

Over the weekend, Bitcoin’s price dipped toward $107,000, but it has since bounced back, trading around $109,500 as the week begins.