Bitcoin (BTC) has not broken below $90,000 since November 18, continuing to oscillate between the $90,000 and $100,000 marks.

When Bitcoin approaches the $100,000 threshold, market sentiment usually turns bullish, as investors attempt to maintain the ongoing bull market. Conversely, as Bitcoin nears the $90,000 level—like it did recently—bearish sentiment can take hold.

Currently, Bitcoin’s movement is dictated by the concept of ‘maximum pain,’ residing in a volatile range between these two valuations.

Derivatives play a significant role in the resulting price fluctuations. Instruments such as futures and options, although representing only a small percentage of overall market capitalization, are becoming increasingly influential in Bitcoin’s dynamics.

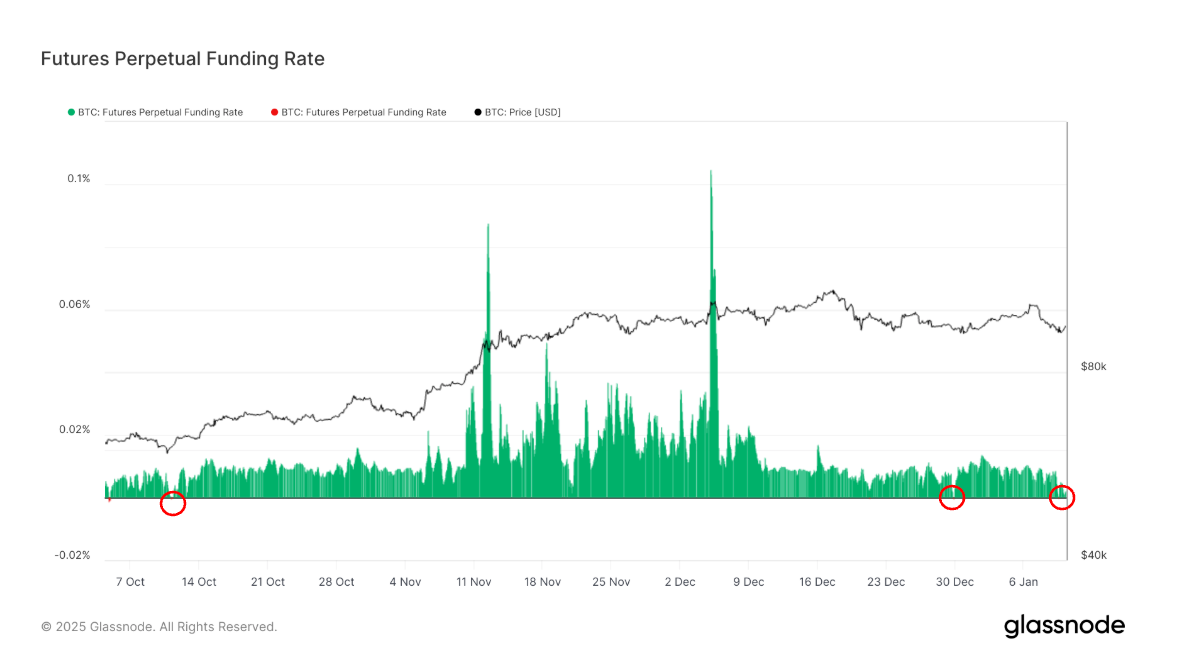

A critical metric observed by traders is the futures perpetual funding rate, which is the average rate set by exchanges for perpetual futures contracts. A positive funding rate indicates that long positions periodically pay short positions, while a negative rate signifies the opposite.

During bullish market trends, Bitcoin typically witnesses a positive funding rate as traders anticipate further price increases. However, when the market reaches an overheated state, a decline often follows, which can trigger a wave of liquidations.

In bear markets, similar dynamics occur; established price floors can lead to rapid rebounds as traders rush to cover their positions, resulting in the formation of local bottoms.

As of yesterday, data from Glassnode indicated a brief negative funding rate of -0.001%, marking the first occurrence this year and only the fewest times since November. This development facilitated a leverage flush and a sentiment shift before Bitcoin rallied back above $94,000.

While a negative funding rate doesn’t always guarantee swift price rebounds or mark definitive bottoms, it should be analyzed alongside other charting tools and technical indicators for a comprehensive market perspective. A negative funding rate can also suggest that a protracted bear market might continue, rather than signifying an immediate bottom. In contrast, positive rates in a bull market might not indicate overheating; they could reflect sustained demand.

Since the beginning of 2023, the funding rate has predominantly been positive, characteristic of a bullish market. Nonetheless, brief intervals of negative rates have typically coincided with price bottoms, similar to those observed during the Silicon Valley Bank collapse in 2023 and again in 2024, just ahead of Bitcoin’s subsequent price rises.

A price floor tends to materialize when the funding rate turns negative and bears exhibit overconfidence. Conversely, bulls may become complacent when spot prices cannot match the levels of leverage being deployed. In both scenarios, traders often face liquidation, and in this particular instance, the recent liquidations primarily affected the bears.