Ripple, along with its native token, experienced an eventful week, marked by significant announcements and notable growth.

Credit Card Focused On XRP Rewards

Gemini unveiled its latest product last week, a credit card that offers holders varying percentages back from purchases directly in the XRP token.

Additionally, it will support Ripple’s stablecoin, RLUSD, which can be utilized for the US spot trading markets on Gemini’s trading platform.

Another XRP ETF Listing, But With A Twist

The Securities and Exchange Commission (SEC) in the United States has a long-standing history of delaying ETF decisions for Ripple’s native token, but it could potentially be different this time.

Filed by an Illinois investment company with over $12 billion in assets under management (AUM), this filing is not a typical spot ETF but will be classified as an Options Income Fund instead.

As the name implies, it will concentrate on options strategies to generate a monthly yield for investors. The options will expire monthly, allowing for a regular strategy reset and a steady income stream for shareholders.

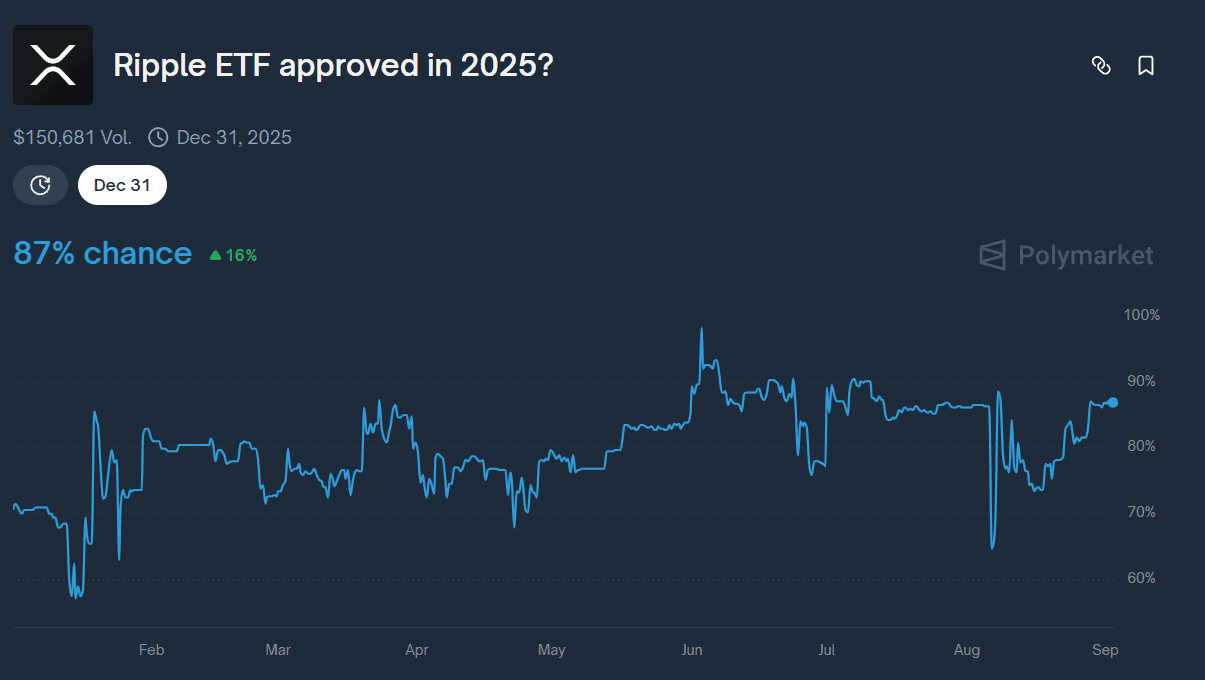

Meanwhile, the odds of a spot XRP ETF approval by the year’s end stand at 87% as per Polymarket.

XRP Ledger Posting Highs

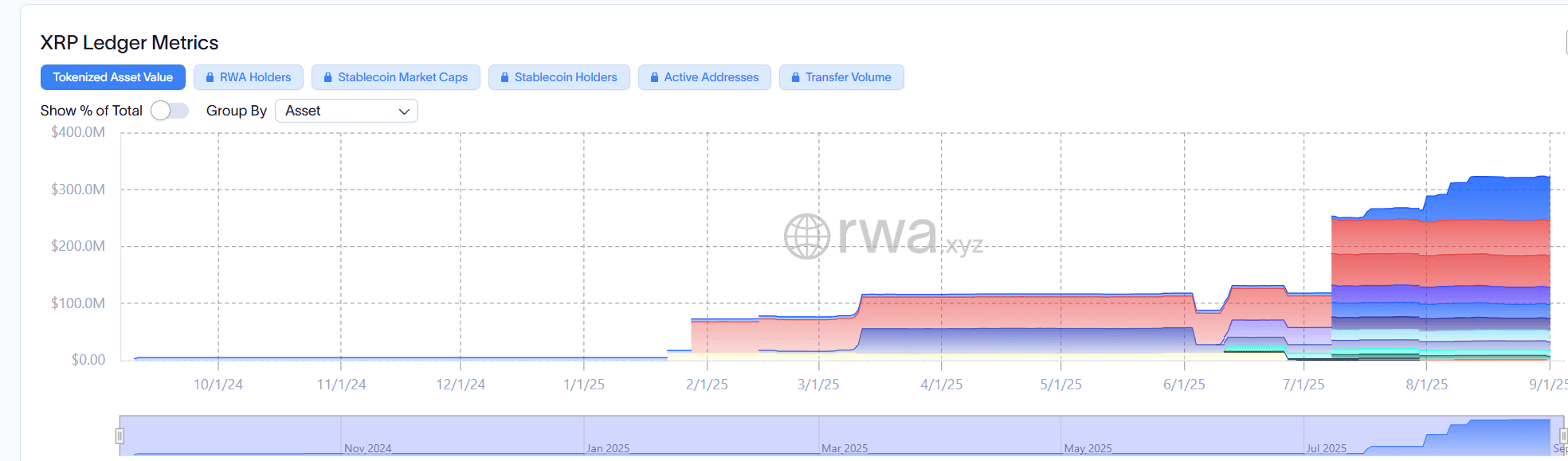

The project’s underlying blockchain has recently reported impressive figures, achieving a real-world asset (RWA) market cap of over $130 million at the end of the second quarter of 2025.

That same metric has shown an impressive jump of 144% to over $320 million in just two months, according to RWA.xyz.

Price Outlook

XRP closed off last Tuesday at the $3 mark, and, at the time of writing, is trading around $2.7, reflecting a 10% drop likely caused by profit-taking and macroeconomic factors.

Current sentiment towards the token on social media appears bullish, with analysts predicting possible rallies and new all-time highs. Additionally, further insights from chartists have outlined crucial steps for XRP to break out of its recent downturn and aim for a new record high.

However, there are also voices preparing for a bear market, presenting potential price targets should buying pressures falter.

This post originally appeared on CryptoPotato.